5 Easy Facts About Financial Advisor Victoria Bc Described

Wiki Article

Not known Facts About Independent Financial Advisor Canada

Table of ContentsSome Of Investment ConsultantInvestment Representative - TruthsIndependent Financial Advisor Canada - TruthsThings about Financial Advisor Victoria BcSome Of Financial Advisor Victoria BcGetting My Independent Investment Advisor Canada To Work

Heath can an advice-only coordinator, this means the guy doesn’t control their consumers’ cash directly, nor really does the guy promote all of them certain financial products. Heath states the appeal of this method to him is the fact that he does not feel bound to provide some item to fix a client’s cash issues. If an advisor is only equipped to sell an insurance-based answer to problems, they might wind up steering someone down an unproductive course in title of striking income quotas, according to him.“Most economic solutions folks in Canada, because they’re compensated according to the services and products they provide and sell, they could have reasons to recommend one course of action over another,” he states.“I’ve picked this program of action because I can seem my customers to them and never feel I’m using them at all or attempting to make a sales pitch.” Story continues below advertising FCAC notes the way you spend your consultant depends upon the service they offer.

More About Retirement Planning Canada

Heath with his ilk tend to be compensated on a fee-only product, therefore they’re compensated like a legal counsel might-be on a session-by-session foundation or a per hour consultation price (independent financial advisor canada). Depending on the array of services together with expertise or common customer base of expert or planner, hourly costs vary in 100s or thousands, Heath claimsThis can be as high as $250,000 and above, he says, which boxes aside many Canadian households with this standard of service. Tale goes on below advertising for anyone incapable of spend fees for advice-based techniques, as well as those unwilling to give up a portion regarding expense comes back or without sufficient money to get started with an advisor, there are lots of less expensive and also cost-free options to take into account.

An Unbiased View of Independent Investment Advisor Canada

Tale goes on below advertisement choosing the best economic coordinator is a bit like internet dating, Heath claims: You should find someone who’s reliable, has a personality match and it is best person your stage of life you’re in (https://worldcosplay.net/member/1710866). Some choose their unique analysts to be more mature with much more experience, he says, although some like some body more youthful who is going to hopefully stay with them from early years through your retirement

Lighthouse Wealth Management - An Overview

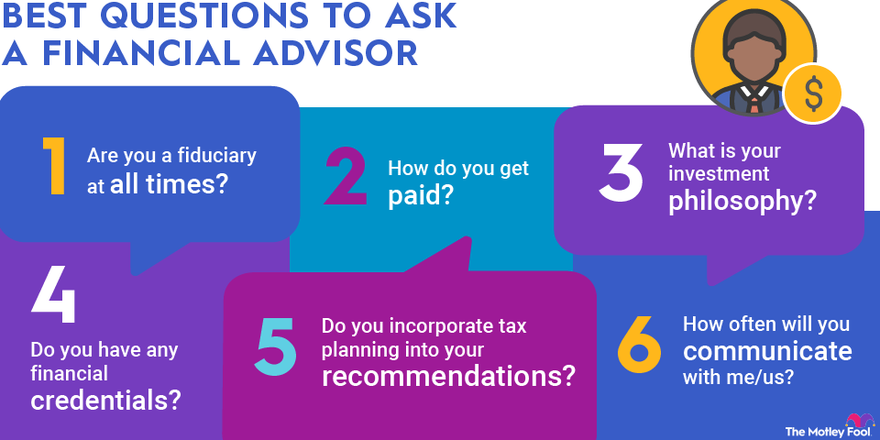

One of the largest errors someone make in choosing a consultant just isn't inquiring enough questions, Heath says. He’s amazed when he hears from customers that they’re nervous about asking concerns and possibly showing up foolish a trend he discovers is equally as normal with established experts and the elderly.“I’m shocked, given that it’s their money and they’re paying quite a few fees to these people,” he states.“You need to own the questions you have answered while have earned having an unbarred and truthful commitment.” 6:11 Investment planning all Heath’s last advice is applicable whether you’re interested in outside economic assistance or you’re going it by yourself: keep yourself well-informed.Here are four facts to consider and have your self whenever finding out whether you need to engage the expertise of a financial consultant. Your net worth is not your income, my latest blog post but alternatively a sum that will help you already know just what cash you earn, just how much it can save you, and the place you spend money, as well.

All about Retirement Planning Canada

Your child is found on ways. Your divorce case is pending. You’re approaching your retirement. These as well as other significant existence occasions may remind the necessity to visit with a financial consultant about your financial investments, your financial objectives, and other financial things. Let’s state the mom remaining you a tidy sum of cash inside her will.

You've probably sketched your very own monetary program, but I have trouble following it. An economic specialist can offer the responsibility that you need to place your economic thinking about track. They even may recommend simple tips to modify your own economic plan - https://myanimelist.net/profile/lighthousewm so that you can optimize the possibility results

4 Easy Facts About Independent Financial Advisor Canada Explained

Anyone can say they’re an economic advisor, but a specialist with pro designations is if at all possible the only you need to employ. In 2021, approximately 330,300 Us americans worked as private monetary experts, based on the U.S. Bureau of work Statistics (BLS). The majority of financial advisors are self-employed, the bureau claims - investment consultant. Typically, you will find five kinds of monetary experts

Agents generally earn commissions on investments they make. Agents tend to be controlled because of the U.S. Securities and Exchange Commission (SEC), the Investment field Regulatory Authority (FINRA) and condition securities regulators. A registered financial investment specialist, either an individual or a strong, is similar to a registered consultant. Both purchase and sell opportunities on the behalf of their customers.

Report this wiki page